HealthSaver+

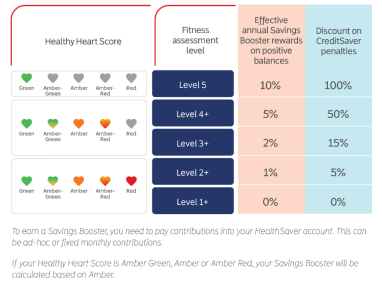

HealthSaver lets you save for medical expenses, such as vitamins, cosmetic surgery and more, while earning Savings Booster rewards of up to 10% on your positive Savings balance, based on a combination of your Healthy Heart Score and fitness assessment.

The HealthSaver account, which costs just R40 a year to administer, is the most convenient way to pay for treatments and procedures not covered by your option.

In fact, you can even use HealthSaver funds to:

- Pay your Momentum Medical Scheme contribution (if you are the contribution payer, and have a minimum positive balance of R2 500 for individual members and R5 000 for families);

- Fund your child’s education (if you have a minimum positive balance of R5 000);

- Boost your retirement (if you have a minimum positive balance of R2 500 for individual members and R5 000 for families);

- Pay for non-medical expenses at pharmacies and veterinarians, using the Scan to Pay feature on the Momentum App;

- Buy a fitness device;

- Gym for free by using the HealthReturns you have earned to pay your gym membership fee; and

- Pay Multiply Lifestyle partners using your Rewards balance.

You can have a HealthSaver account without making contributions into it – it could simply be where you receive the HealthReturns+ you earn.

To track your activity and earn Active Dayz, you can use your HealthSaver funds to buy a fitness device. You could say you are buying or upgrading your fitness device for free, considering you can pay for it with the HealthReturns you may have already earned. Or, if you applied for a CreditSaver facility on your HealthSaver account, you could buy a fitness device with that credit from as little as 0% penalties, depending on your Healthy Heart Score and fitness level.

Let’s have a closer look at just some of the healthcare related expenses that you could pay for with HealthSaver funds:

- GP visits, consultations and prescription medication;

- Medication, provided it has a NAPPI code;

- Services rendered by a registered healthcare provider, provided it has a tariff code;

- Claims that exceed available Scheme benefits, such as specialised dentistry;

- Treatment that is excluded by the Scheme, such as cosmetic surgery;

- Co-payments payable for hospitalisation, MRI and CT scans or medication;

- Virtual consultations and prescription medication through Hello Doctor;

- Fitness assessments at Multiply’s health professionals network. Log in to the app for a complete list of health professionals;

- Smokenders;

- Danni Health, nutritional coaching;

- Reinvent Health, nutritional coaching;

- DNAlysis;

- Omninela;

- Tailorblend, personal supplements;

- Doc Marty’s Mushrooms, supplements;

- Truwellness, wellness products;

- Fitness apps or devices; and

- Registered independent gym fees:

- If you are a member of Planet Fitness, Zone Fitness, Body20 or SISSA (you need to have joined this gym via Multiply) you can pay your gym fees using your Rewards on the Momentum App.

- For other registered gyms (you need to have joined this gym via Multiply), if you submit your bank statement or an invoice to us showing that you paid your gym fees, we will manually reimburse you from your HealthSaver account.

Scan to Pay

You can access your HealthSaver funds with the Scan to Pay feature on the Momentum App. You can pay for purchases and services at the following providers and retailers:

- Doctors, hospitals and pharmacies

- Dentists and orthodontists

- Medical services, medical and dental laboratories

- Medical, dental, ophthalmic and hospital equipment and suppliers

- Providers of orthopaedic goods, such as prosthetic devices

- Osteopaths, chiropractors, chiropodists and podiatrists

- Optometrists, ophthalmologists, opticians, optical goods and prescription glasses

- Nursing and personal care

- Ambulance services

- Hearing aid sales and supplies

- Veterinary services

You will be able to view these purchases on your monthly HealthSaver statement or on the Momentum App. To request access to the Scan to Pay feature on the Momentum App for your dependants, you can email us at [email protected]. Include your Momentum Medical Scheme membership number and details of the dependant for whom you are requesting access.

Want to know more about the HealthReturns you can earn?

Multiply Inspire members can earn up to R250 a month in HealthReturns, while Multiply Inspire Plus members can earn up to R1 000 a month. Start earning HealthReturns from day one for every step you take towards knowing and improving your health. Log in to the Momentum App and tap on Multiply to do the quick Lifestyle Quiz. You’ll can do your digital health and fitness assessment on the app and get your Healthy Heart Score and fitness level in just 15 minutes. Plus, you’ll also get access to Wysa, Multiply’s 24/7 digital mental health support, and Multiply partners that are carefully curated for access to DNA testing, nutritional coaching, quality supplements and much more.

HealthReturns are paid into your HealthSaver account and accumulate towards your Rewards balance.

Who is eligible for HealthSaver?

All Momentum Medical Scheme members qualify for HealthSaver. You can sign up for a HealthSaver account via the Momentum App and enjoy immediate access. If you opt to apply for CreditSaver, you can do so in real time. Irrespective of whether you have a waiting period on the Scheme, you will have access to your HealthSaver account as soon as you join.

FICA

In terms of the Financial Intelligence Centre Act (FICA), we need to successfully perform FICA verification on all members applying for HealthSaver before we activate the HealthSaver account. If we don’t receive this information, we will not be able to activate your HealthSaver account. For online applications via the web or Momentum App, follow the prompts for copies to be submitted or information to be captured, in order for FICA to be performed.

Not sure whether to contribute or not?

You do not have to pay money into your HealthSaver - it could simply be the account where you receive your HealthReturns. If you would like to make provision for additional day-to-day healthcare expenses by contributing monthly to your HealthSaver account, you get to choose how much, and can easily change that amount at any time during the year.

If you choose to make monthly contributions, the minimum amount is R100 per month and the maximum amount for debit orders is R11 500 per month. You can apply for CreditSaver. This annual credit facility is based on your monthly HealthSaver contribution, eg if your contribution is R500 per month, your credit facility will be R6 000 for the year. If you join during the course of the year, your upfront balance will be pro-rated. The maximum annual credit allowed is R36 000 (based on a monthly contribution of R3 000), subject to National Credit Act (NCA) requirements. You can also deposit any lump sum amounts, in addition to monthly payments. Lump sum deposits from R50 000 and above are subject to Anti-Money Laundering audits. An annual administration fee of R40 will apply and will be deducted in January of each year. Cash withdrawals and transfers are not allowed. Any positive balance in this account, excluding HealthReturns, is paid out to you after four months if you cancel your Momentum Medical Scheme membership or HealthSaver account.

Applying for CreditSaver

You can easily apply for credit in real time. If you apply for credit (new applications or changes to existing HealthSaver CreditSaver), you will be offered the opportunity to accept the credit terms before Momentum grants the credit. You will receive communication prompting you to confirm acceptance of the credit terms. If we do not receive your acceptance within 60 days for members linked to employer groups and 30 days for members applying in their individual capacity, your HealthSaver account will be activated without a credit facility. Credit granted will be pro-rated per calendar year.

Where an employer would like to extend the HealthSaver CreditSaver to all employees, regardless of whether they meet NCA requirements, the employer can consider signing the Momentum Deed of Suretyship for employees who do not meet the requirements. We use a predictive scoring system to determine the penalty rate you will pay on credit. This scoring system takes your financial records and current credit status into consideration. Penalties on CreditSaver are calculated at the end of each month on the daily change in the HealthSaver balance. If you use the credit facility, we charge you a penalty of prime plus 6%. The penalty rate that we charge will change if the prime lending rate changes. As the principal member, your Healthy Heart Score and fitness assessment result can reduce the penalty you pay on credit to 0%, or help you earn up to 10% Savings Booster on your positive Savings balance.

To earn Savings Booster rewards, you need to make a deposit into your HealthSaver account.

The discount on HealthSaver CreditSaver penalties is calculated monthly using retrospective data and will not be adjusted during that month, despite any adjustments to fitness assessment results or Healthy Heart Score. If you have not done your annual health assessment, it will mean that we do not know your Healthy Heart Score and cannot apply the discount on HealthSaver CreditSaver penalties or Savings Booster rewards on your positive Savings balance. Similarly, these benefits will not be available if you do not meet any chronic compliance requirements that may apply to you in terms of the HealthReturns programme.

How to claim from HealthSaver

HealthSaver funds can be used to pay claims for you and your registered dependants on Momentum Medical Scheme. Claims are submitted and paid via the normal administration process, and you will receive monthly claims statements reflecting the amounts paid and the available balance. Claims need to be submitted with a valid practice number and tariff code or NAPPI code.

You can choose whether your HealthSaver claims should be paid at cost, or up to 200% of the Momentum Medical Scheme Rate. If you do not choose to have your claims paid at cost and subsequently require payment above these rates, we will need a written request to do so.

To claim for fitness devices, send the invoice with your proof of payment to us via email at [email protected]. To claim for gym membership fees, submit your bank statement or an invoice showing that you paid your gym fees (you need to have joined this gym via Multiply) to us at [email protected]. You can pay your Planet Fitness, Zone Fitness, Body20 or SISSA gym fees, using your Rewards, on the Momentum App.

Use the Scan to Pay feature on the Momentum App at a healthcare provider. Your HealthSaver balance will be updated accordingly. To claim a refund for claims paid to your healthcare provider, email the account and the Point of Sale (POS) receipt to [email protected]. If you would like the payment to be recorded for tax purposes only, write clearly on the claim that it is for tax purposes and submit it in the same manner.

Tax implications

Tax treatment of the HealthSaver differs from the tax treatment for medical scheme savings. Medical scheme savings are incorporated into the medical scheme contributions, while contributions made to the HealthSaver are funded from after-tax income. HealthSaver contributions are not deductible, however, most expenses paid via the HealthSaver are tax deductible in the same way as healthcare expenses you incurred yourself.

You will receive a HealthSaver tax statement that you may use as proof of the healthcare expenses paid during the tax year. Deductions can be made accordingly, provided that all healthcare spend not covered by the Scheme is shown in the HealthSaver statement, ie no additional receipts are required. The tax certificate will include descriptors of the healthcare expenses paid, as required by SARS. Any non-deductible items, such as gym fees and fitness devices paid from your HealthSaver funds, will not reflect on your tax certificate.

Scan to Pay transactions will not reflect on your tax certificate.

Contribution holidays

If you have a positive HealthSaver balance, you can apply for a contribution holiday. If the contribution holiday is approved, your credit facility will be suspended but claims will still be paid from your available HealthSaver funds.

Funding education expenses from Rewards

You will be able to use your Rewards balance to pay your child dependants' education expenses once a year (fees applicable for the current year only), provided at least R5 000 remains in your HealthSaver account.

In order to qualify, your dependants must be registered on your Momentum Medical Scheme membership. This is available in February and March each year. You need to submit invoices from officially registered educational institutions, with proof of payment, for reimbursement.

Payment of medical scheme contributions from HealthSaver

This option is available if you pay your contributions directly to Momentum Medical Scheme. In other words, if your contribution is deducted from your salary (ie paid by your employer) you will not be able to fund your contributions from your HealthSaver.

If you would like to pay your medical scheme contributions from your positive HealthSaver balance, contact us via the web chat facility on momentummedicalscheme.co.za, email us at [email protected], WhatsApp or call us on 0860 11 78 59, or submit a request via the Momentum App.

Please note:

- You or your financial adviser will need to let us know how many months’ contributions you would like to fund from your HealthSaver.

- We need to receive your request at least seven working days before the 1st of the month.

- Medical scheme contributions can be paid from positive HealthSaver funds (actual and Booster).

Contributions can only be funded up to 1 December of the same year and cannot continue into the following calendar year. If the above criteria are met, the request is approved and the total amount (for the requested number of months) will be paid from your HealthSaver account to Momentum Medical Scheme. If you would like to stop funding your medical scheme contribution from your HealthSaver account before the requested number of months is completed, contact us at least seven working days before the 1st of the month. The unused balance of the amount paid to Momentum Medical Scheme will be refunded into your HealthSaver account.

Transfer of funds to FundsAtWork

If you have accumulated excess funds in your HealthSaver account, you can invest some of these funds to supplement your retirement savings. Once a year, if your HealthSaver balance is more than R2 500 for individual members or R5 000 for families (excluding any credit facility) and you are an active, contributing member of the FundsAtWork Umbrella Pension or Provident Funds, you can transfer your excess HealthSaver funds to FundsAtWork. For example, if the balance is R20 000, you would be able to transfer R15 000 if you have a family membership.

The transfers will be available in November of each year. If you want to take up this offer, let us know by no later than 30 November. You can email us at [email protected], or request the transfer on the Momentum App. The actual transfer of the funds will take place no later than 31 January of the following year and you will receive a letter from FundsAtWork confirming the transfer values. The amount transferred will show as an additional voluntary contribution (AVC) in the FundsAtWork Umbrella Fund. You can claim the AVC from SARS as a tax deduction, as long as your total contributions don’t exceed the legislated maximum amount. The amount transferred into FundsAtWork will be invested in the same investment portfolios as your future contributions.

Transfer of HealthSaver funds to another Momentum Medical Scheme member

HealthSaver members can transfer funds from their active HealthSaver account to another member’s HealthSaver account.

No cash transfers from a HealthSaver account to a bank account will be permitted. Members will be able to transfer Savings balances to another HealthSaver account. A member’s Rewards balance can only be transferred to another HealthSaver account in the case of a principal member becoming a dependant on someone else’s membership, provided there is no break in membership.

If you would like to transfer funds from one HealthSaver account to another, contact us via the web chat facility on momentummedicalscheme.co.za, email us at [email protected], WhatsApp or call us on 0860 11 78 59, or submit a request via the Momentum App.

Adding funds to HealthSaver

You can make ad-hoc deposits into your HealthSaver account, using the following banking details:

| Bank | First National Bank |

| Account name | Momentum Health (Pty) Ltd – Momentum HealthSaver |

| Account number | 62176002469 |

| Account type | Current account |

| Branch code | 22 36 26 |

| Branch name | Corporate Account Services – Durban |

For the beneficiary reference, use HS and your Momentum Medical Scheme membership number, eg HS123456. It is important for you to use the correct reference number and email a copy of your deposit slip as proof of your payment to us at [email protected], to make sure that we allocate your money correctly.

What happens if you cancel your Momentum Medical Scheme membership or HealthSaver account?

If you cancel your Momentum Medical Scheme membership and/or your HealthSaver account, your HealthSaver balance will be paid out to you after a period of four months (to allow for any outstanding claims to be processed). Any funds earned from HealthReturns will, however, be forfeited and no Savings Booster rewards are payable during the four-month period. If you cancel your HealthSaver account and do not claim your positive balance within four months after the cancellation date, we will charge a monthly administration fee from the fifth month onwards. This fee will be for the cost of maintaining the dormant account.

What happens if your HealthSaver account is suspended?

If your HealthSaver account is suspended, we will store your HealthReturns for a period of three months. If your account is reinstated within the three months, we will pay your accumulated HealthReturns into your HealthSaver account. If not, you will forfeit your HealthReturns.

Disclaimer: +Momentum Medical Scheme members may choose to make use of additional products available from Momentum Group Limited and its subsidiaries as well as Momentum Multiply (herein collectively referred to as Momentum). Momentum is not a medical scheme and is a separate entity to Momentum Medical Scheme. Momentum products are not medical scheme benefits. You may be a member of Momentum Medical Scheme without taking any of the products offered by Momentum.